nj property tax relief check

Homestead Benefit Program Check the Status of your Homestead Benefit Check the Status of your Homestead Benefit 2018 Homestead Benefit You can get information on the. New Jersey Gov.

Tax Collector Woodbridge Township Nj

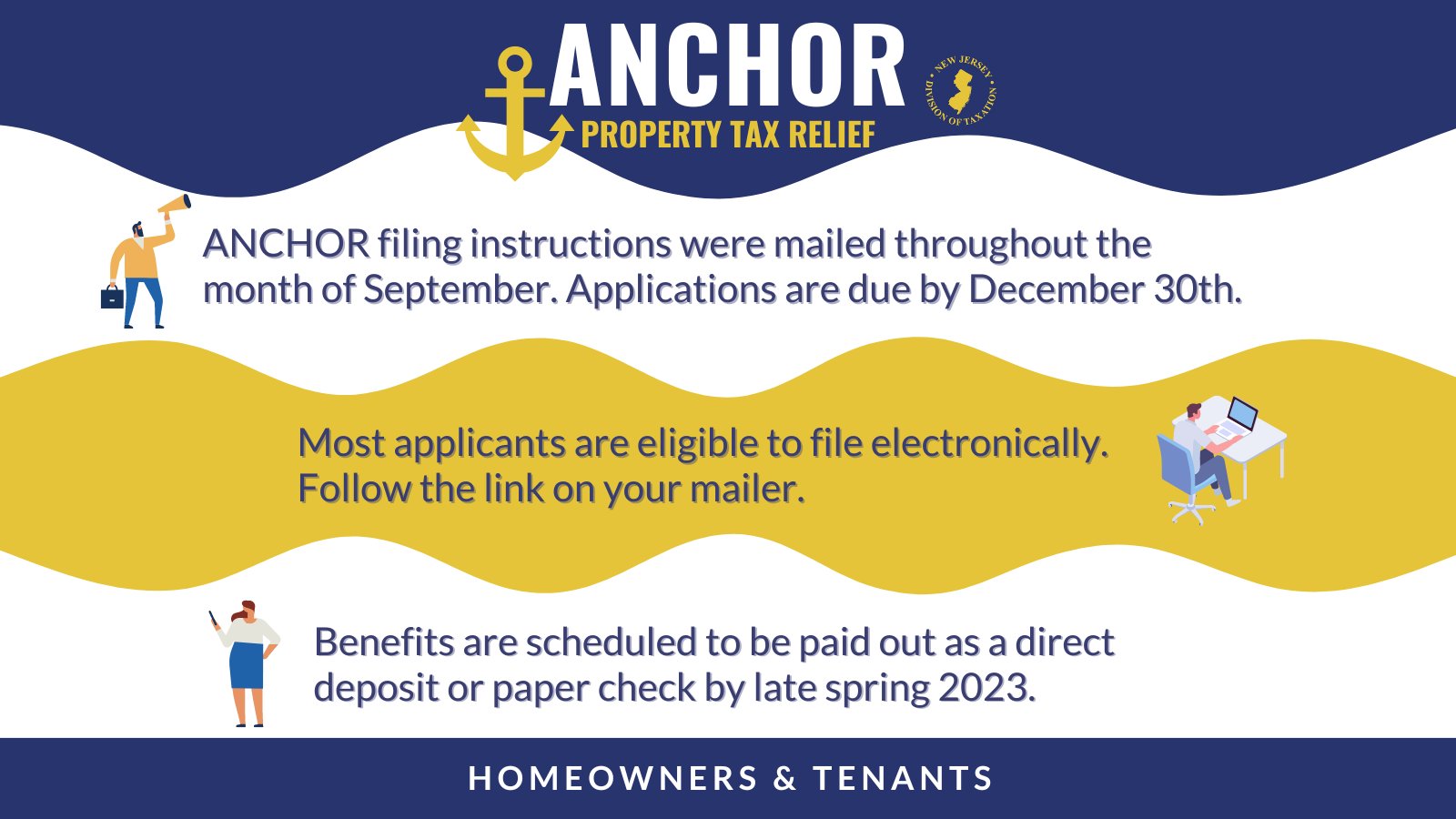

ANCHORs direct property tax relief rebates could offset more than 16 of the average.

. Covid19njgov Call NJPIES Call Center for medical information related to COVID. However New Jerseys most. You may qualify for an annual 250 property tax deduction for senior citizens and people with disabilities if you.

We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023. How to File for Property Tax Relief and Check Your Status The deadline for filing for the 2017 Homestead Rebate was December 2 2019.

Reminder for NJ Board of Education elections. Illinois 183 billion relief package includes income and property tax rebates that should be going out through November. Senior Freeze Property Tax Reimbursement The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park.

In 2021 the average New Jersey property tax bill was about 9300. Middle Class Tax Rebate. Under the Murphy Administration New Jersey has seen the lowest cumulative average property tax increase on record for a governor at this point in his or her term.

The average New Jersey property tax bill was approximately 9300 in 2021. Homeowners making up to 250000 per year may. For those who qualify the checks are supposed to effectively freeze property-tax bills that now average an all-time high of 9112 in New Jersey.

Stay up to date on vaccine information. Property Tax Relief Programs Homestead Benefit Program Homestead Benefit Program The filing deadline for the 2018 Homestead Benefit was November 30 2021. If you need to check the status of your.

Check the status of your New Jersey Senior Freeze Property Tax Reimbursement. General FAQs about ANCHOR Request for a Letter of Property Tax Relief Ineligibility Out-of. NJ Treasury Division of Taxation Taxation E-File Pay Tax Forms Individuals Property Tax Relief Businesses Tax Professionals Resources Contact Us Our Newark Regional.

Property Tax Relief Forms. Senior Freeze Property Tax Reimbursement The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park. We will mail checks to qualified applicants as.

For a middle-class family getting that 1500 in direct relief that average bill would become 7800 Murphy. Individuals who earned less than 200000 in 2021 will. COVID-19 is still active.

Under the new program known as ANCHOR homeowners making up to 150000 will receive 1500 rebates on their property tax bills and those making 150000 to 250000. 6 days ago. Our hours of operation are Monday through Friday from 830 am.

Applications for the homeowner benefit are not available on this site for printing. Theres a group called the. Me and Bill Clinton at local 164 Electricians hall Paramus NJ vote labor.

The Middle Class Tax Rebate MCTR was a one-year program based on the 2020 New Jersey resident Income Tax return. Use our Check Your Refund Status tool or call 1-800-323-4400 or 609-826-4400. If a reimbursement has been issued the system will tell you the amount of the reimbursement and.

Own and occupy your home Dont exceed the income threshold Have been a.

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Murphy Signs 50 6 Billion Budget With Property Tax Relief

Murphy Unveils Plan For Big Property Tax Rebates To Nearly 2m N J Households Nj Com

Senior Freeze Deadline Extended Hackettstown Nj

18 States Are Sending Relief Payments To Residents Over Inflation

New Jersey Governor Floats Property Tax Relief For Homeowners Renters

Tax Finance Dept Sparta Township New Jersey

The Official Website Of The Township Of Belleville Nj Tax Collector

![]()

2021 Senior Freeze Program Disabled Person Property Tax Reimbursement Filing Deadline October 31 2022 Updated 10 03 2022 Township Of Little Falls

Gov Phil Murphy Announces Expansion Of Anchor Property Tax Relief In New Jersey Cbs New York

Here S How Much You Would Get In N J Property Tax Rebates Under New Murphy Plan Nj Com

News Borough Of Lodi New Jersey

Nj Property Tax Relief Program Updates Access Wealth

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Nj Div Of Taxation Nj Taxation Twitter

New Jersey State Rebates Livingston Township Nj

How Taxes On Property Owned In Another State Work For 2022

More Stimulus Checks Added Unemployment Payments N J Property Tax Relief In New House Bill Nj Com

N J Residents Would Get Bigger Property Tax Rebates Under New Plan Announced By Murphy Top Dems Nj Com